I have a friend who is professionally trained, excellent at his job, and makes an enviable income. He wants to improve his lifestyle through real estate investing. While he has found some options, he is frustrated because he can’t access all the available deals. Why? –– because he’s not an accredited investor.

What does it mean to be an accredited investor and why should you care?

Like many people, you might have started your investing career by first creating a savings account, then migrating to curated retirement vehicles such as 401(K)’s, IRA’s and other similar accounts. Following that, you might have participated in the stock market, either through a broker, or on your own.

If you are serious about your financial independence, you have likely grown beyond the world of retail investment and have expanded into other avenues for wealth creation and cash flow. One option is private investments.

Examples of private investments include participation in limited liability offerings to purchase real estate, explore natural resources, or start a business, to name a few. Private and public investments each have their own advantages and disadvantages.

Private investments are not necessarily correlated with the broader equities market and sometimes provide niche opportunities. One component of some private investments is cash flow, which can be used to replace earned income, and potentially, create some job freedom.

Many, but not all of these opportunities require you to be an accredited investor. The definition of an accredited investor is:

- A person with an annual income exceeding $200,000 ($300,000 for joint income) for the last two years with the expectation of earning the same or a higher income in the current year.

- A person with a net worth exceeding $1 million, either individually or jointly with their spouse.

- An entity that is a private business development company or an organization with assets exceeding $5 million. If an entity consists of equity owners who are accredited investors, the entity itself is an accredited investor.

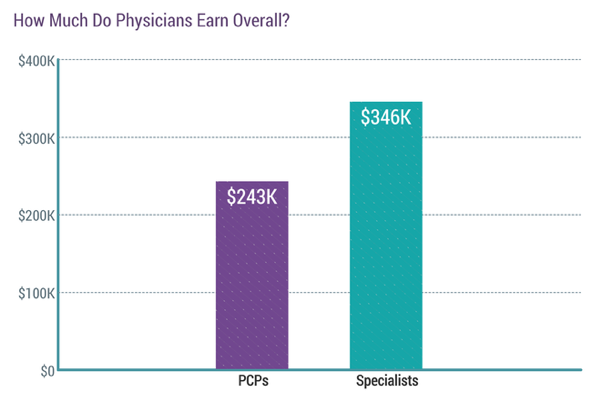

If you’re a physician and have been working for more than two years, it’s likely that you qualify as an accredited investor. According to the 2020 Medscape Physician Compensation Report, the average physician makes over $200,000/year.

Medscape Physician Compensation Report 2020

However, not all physicians qualify based on income or net worth, many are married and don’t satisfy the joint income threshold, and some haven’t been working long enough to satisfy the two-year status.

What do you do if you wish to participate in a private offering? Your options are to find an investment offering that doesn’t require accreditation, or to become accredited another way.

On December 8, 2020, a new SEC rule became effective, which provides more options. Now, if you don’t have the financial qualifications, you can achieve accredited status another way. There are multiple parts to the new rule, but the most relevant is the ability for holders of certain financial designations to be considered as accredited investors.

The new rule states that holders of the Series 7, Series 65 and Series 82 designations will be considered accredited investors, due to their perceived knowledge of the financial markets.

These are the tests that are taken by financial advisors, but they are available to you as an individual. There are plenty of preparatory classes and study guides available.

Here’s the breakdown:

Series 7

The Series 7 requires passing the Securities Industry Essentials (SIE) exam first and it requires sponsorship by a firm registered with the Financial Industries Regulatory Authority (FINRA). This can be done, but it requires two tests, and a sponsor. Finding a FINRA member to sponsor you is not a simple process.

It is a 125-question test, requires 72% to pass, and costs $245.

Series 82:

The Series 82 requires passing the SIE exam and also requires sponsorship by a FINRA member.

It is a 50-question test, requires 70% to pass, and costs $40.

Series 65:

The Series 65 requires no SIE exam and does not require sponsorship by a FINRA member.

It is a 130-question test, requires 70% to pass, and costs $175.

You can register for all these exams at the FINRA site.

Based on the information above, the Series 65 appears to provide the least path of resistance to acquiring a financial designation and status as an accredited investor. This could potentially open up the world of private investing to those who desire to do so but could not participate before.

Becoming an accredited investor doesn’t automatically make you successful, or knowledgeable about private investments. I encourage you to continue your education and to evaluate each new opportunity thoroughly. As you get in the game and participate, you will learn more!

As always, this content is designed only to educate and inform. If you wish to act on any of the information, please consult your advisors.