Is inflation good or bad?

It depends on your point of view.

I used to buy gas for $0.59/gallon. Yesterday I paid $2.27/gallon to fill my truck. (Gas is cheap in Texas.) That’s a big cost increase for me.

On the other hand, I once bought a property for $83,000. Now it’s worth $265,000. That’s a nice profit for me.

Inflation

Most of us know that inflation is ever-present. Let’s start by defining why it exists.

Simply defined, inflation is the slow and relentless erosion of a currency’s buying power. This is evidenced by the increasing price of groceries, gas, lumber, housing and education, to name a few.

The cause is related to three primary factors:

- Component costs increase for businesses, cars, refrigerators, houses, etc. That raises the cost of the finished product or service.

- The law of supply and demand. Increasing demand for products will raise prices.

- Increased money supply. Governments are prone to print money, which creates too much money to chase too few goods and services.

Effect on Your Dollars

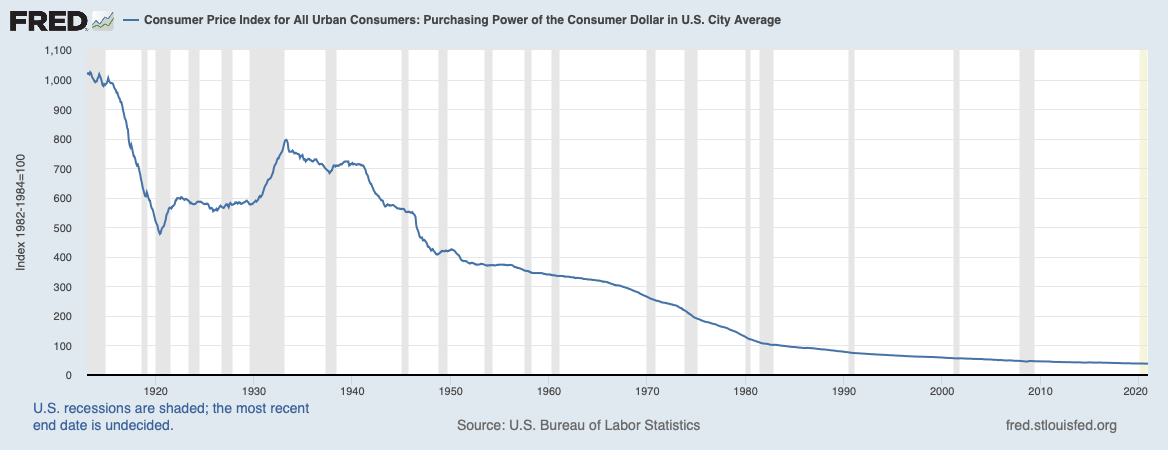

These factors have had their effect to varying degrees over the past century, as evidenced by the graph below. The dollar has lost over 96% of its buying power in the last hundred years.

Over the past twenty years, inflation hasn’t been a big worry, and has been running at roughly 2%. (Disclaimer: This is the official government number and is based on a specific, narrow set of criteria. Real consumer inflation is much higher, but I won’t try to quantify it here. The effect on your spendable currency is much worse.) In real terms, that means that your dollar today will buy ninety-eight cents of product one year from now. That doesn’t sound so bad, does it?

Take that process out five years and your dollar now only buys ninety cents worth of product. That’s starting to hurt a little, isn’t it?

Imagine if you had a savings account of one-million dollars. In five years, it would only buy $900,000 worth of product. That’s a $100,000 loss, simply due to inflation.

Increase that inflation rate to 3% and the “loss” on that million dollars is now $141,266. Ouch!

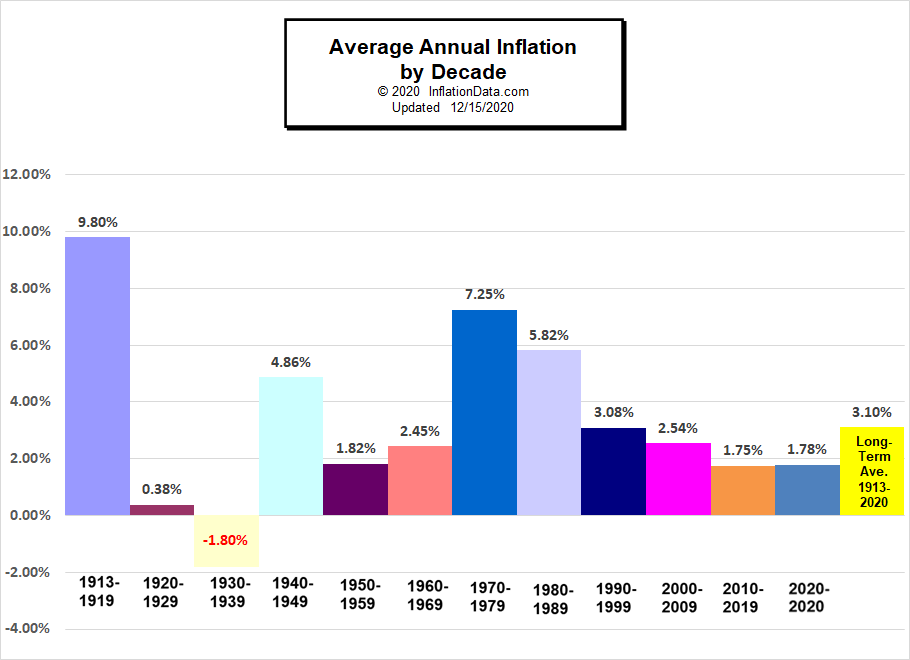

As noted in the graph below, the long-term average inflation rate from 1913-2020 was 3.1%. The average inflation rate over the past 20 years has only been 2.15%. It is during the past two decades that most people reading this post have either entered the workforce or started their investing careers..

If you had $100,000 in 2000, due to inflation, it would only buy $65,411 worth of product today. Put differently, for something worth $100,000 in 2000, you would have to pay $152,877 today.

We have benefitted from low inflation rates for the past 30 years and most investors could assume that is the norm. How much worse will those numbers be if we experience higher inflation rates?

If not managed, inflation will silently steal your money. Former President Ronald Reagan put it this way, “Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.”

Why We Will Have More Inflation Going Forward

There is no guarantee that rampant inflation is imminent. However, most of the smart people I know believe that inflation will be higher over the next two decades than it has been for the past twenty years. The rationale is:

- The US debt to GDP ratio is increasing yearly. The annual debt/GDP ratio is now over 1. That means our annual debt cost is now more than our annual revenue. The government will need to print money to pay that debt.

- In times of recession, increased government debt has boosted the economy. They will do it again.

- The Fed is actually signaling that we are going into a period of higher inflation. They used to target inflation of 2%. Now they are targeting above 2%

- Today there is money printing in response to a viral pandemic. That bill will come due.

How you can Prosper

Sounds gloomy, right?

Well, it’s not. You can prosper in the face of inflation by using debt.

That might sound counterintuitive because most of us were taught to stay out of debt. In fact, Ben Franklin said, “Never a borrower or a lender be.” And wealth guru, Dave Ramsey says, “You can’t win if you’re in debt.”

I agree with these guys – if you have bad debt.

In my book, Why Doctors Don’t Get Rich, I talk about good debt and bad debt. Bad debt takes money out of your pocket and good debt can make you rich. The premise is that fixed debt is a hedge against inflation.

Grant Cardone is a brash guy, but he knows how to make money. He has this to say about debt: “Rich people use debt to leverage investments and grow cash flows. Poor people use debt to buy things that make rich people richer.”

Good debt can be your friend and will allow you to hedge against inflation. In the real estate world, you can erode your debt using inflation. In essence, your good debt can become an asset.

For example, in today’s low interest rate environment, you can purchase a rental property with fixed debt. For example, you buy a $100,000 property with an 80% loan with a rate fixed at 4% for 30 years. Your payment will be $382. In ten years, with 3% inflation, your payment will still be $382, but only $281 in today’s dollars. You are paying with cheaper, inflated dollars and the bank is happy about it.

What else happens during those ten years? Due to inflation and price increases, your rental property rises in value. At a 3% rate of inflation, your property is now worth $134,391. You have added $34,391 to your net worth.

That’s not all. Your tenants have been paying down your loan for ten years so now you only owe the bank $63,027. That’s another $16,973 to add to your net worth, giving your ten-year-old $100,000 a value of $151,364.

If you had put that $100,000 in a cookie jar, it would be worth $73,742 in ten years.

Winners and Losers

The example above explains why savers will be losers in an inflationary environment as their cash erodes. Those with fixed incomes, stagnant salaries or variable debt will suffer.

The winners will be those that invest in hard assets that hedge against inflation. Those with fixed debt, physical assets and precious metals will prosper. I favor land, real estate and gold, but that might not fit your profile.

In an inflationary environment, debt will be an asset, cash will be a liability, and real estate will be a hedge.

With a little education, you too can take advantage of inflation to prosper. The government will need inflation to boost the economy and it will surface one way or another, so one strategy is to follow that wave and profit!

As always, consult with your advisors and create a plan that fits your personal situation.